How To Calculate Gain Or Loss On Repossession

This will reduce the current gain or increase the current loss on the repossession. The rules for figuring these amounts depend on the kind of property the taxpayer repossess.

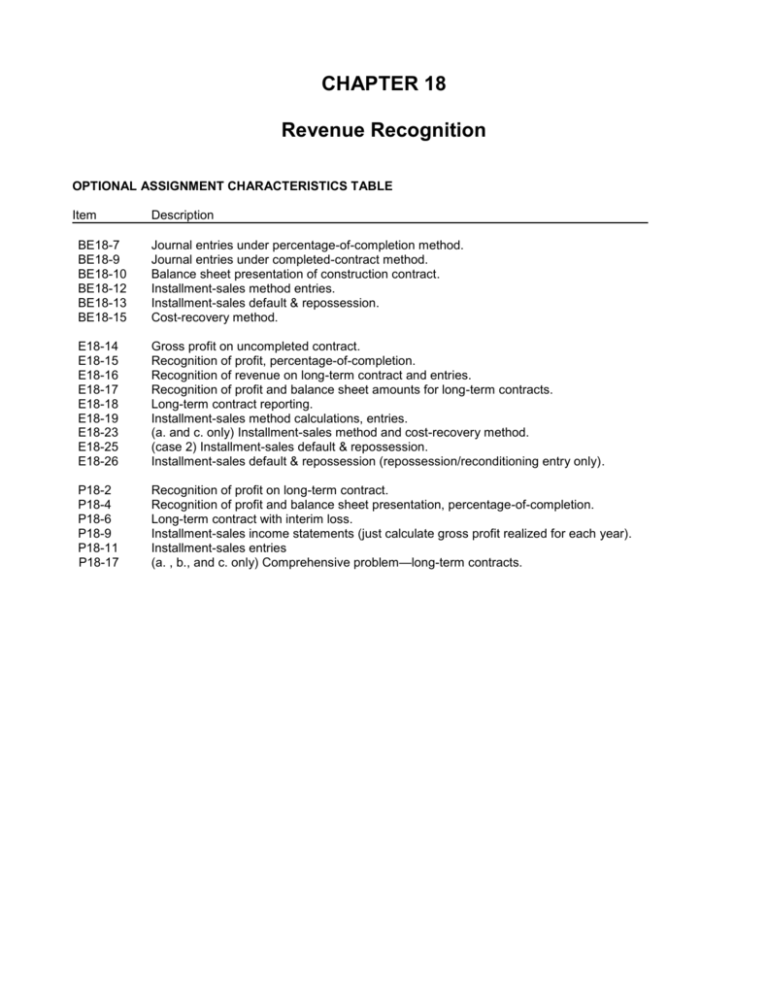

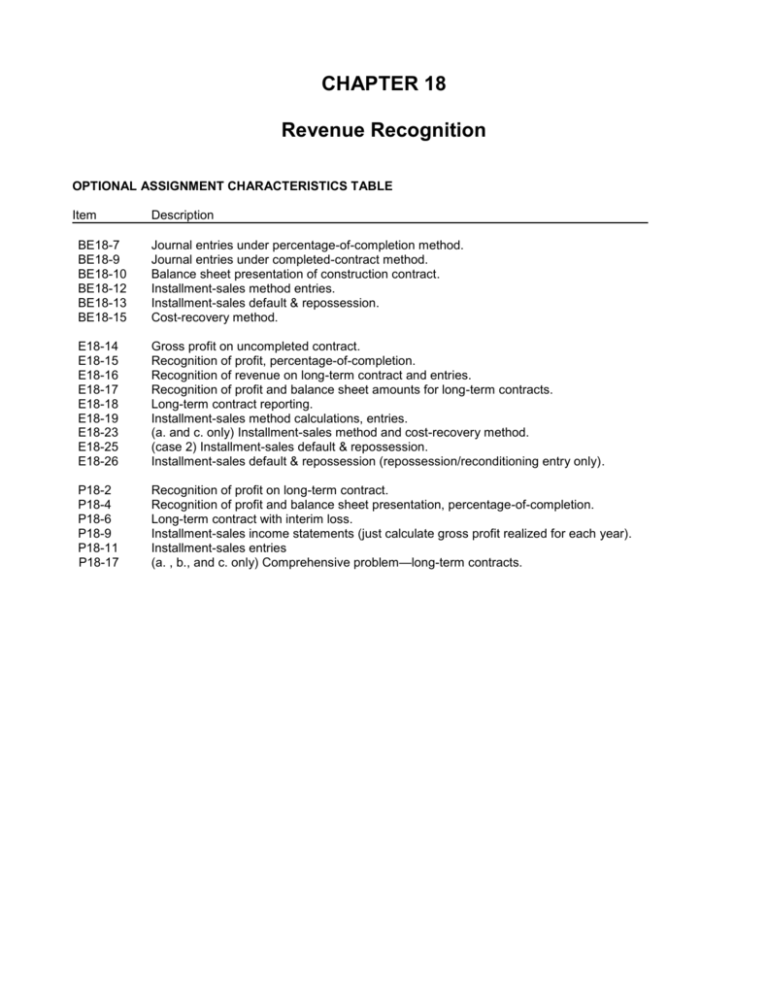

Chapter 18 Revenue Recognition

In order to know the assets book value at the time of the sale the depreciation expense for the asset must be recorded right up to the date that the asset is sold.

How to calculate gain or loss on repossession. Figuring Adjusted Basis and Gross Profit Percentage. Multiply line 2 by line 3. This tax worksheet determines in separate parts the taxable gain on repossession of real property sold on the installment method and the basis of the repossessed property.

The total payments received or considered received on the sale. If the cash received is less than the assets book value the difference is recorded as a loss. Enter your adjusted basis for the property.

Enter the selling price for the property. How do I calculate gain or loss on a foreclosed property. This includes the reportable gain or loss after repossession costs are taken into account.

The dollar amount of the gain or loss is divided by the original purchase price to create a decimal. Enter any depreciation recapture. The rules for repossessions of personal property differ from those for real property.

Enter your selling expenses. The loss is the difference between the adjusted basis in the transferred property and the amount realized adjusted basis minus amount realized. The amount Chris realized on the repossession is 10000.

Instead the gain or loss on repossession equals. The fair market value of the repossessed property at the repossession date less The sum of. Subtract any costs associated with the investment.

The total gain already reported as income. This is the total amount you have been paid or have received for this property before it was. Figure the gain or loss from a foreclosure or repossession the same way as the gain or loss from a sale.

Add lines 5 and 6 8. This is used in calculating your gain or loss on the repossession. Repossession of Real Property Calculator.

Limit on taxable gain. Basis of obligation 6. That is the outstanding amount of the debt canceled by the repossession even though the cars fair market value is less than 10000.

Add lines 2 3 and 4. Any gain or profit you reported on the sale of this property. Gain Previously Reported Deferred Or Excluded.

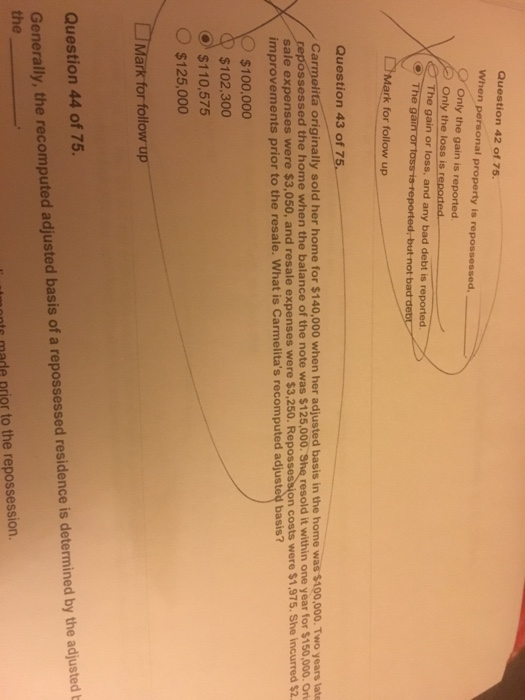

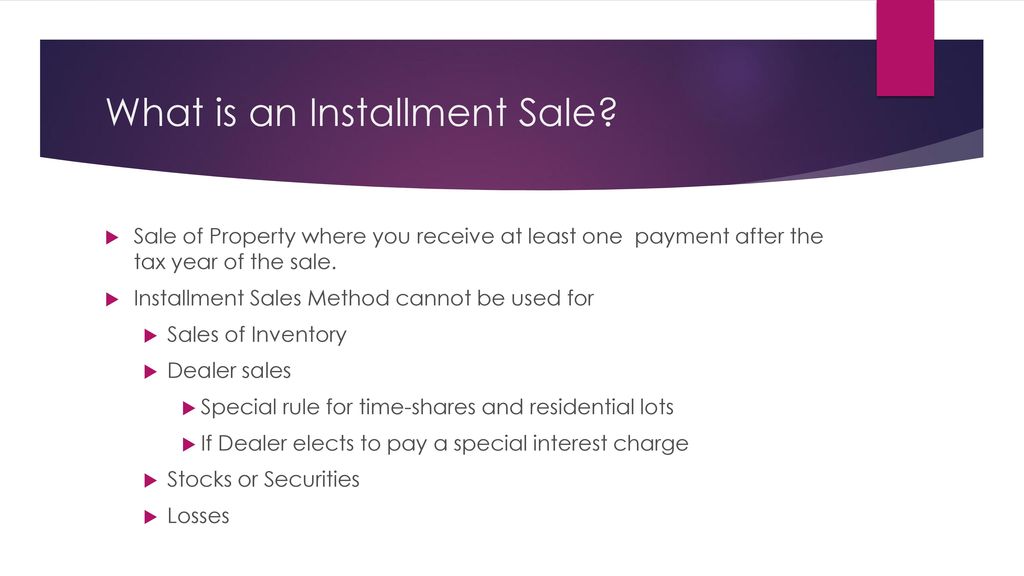

We use cookies to give you the best possible experience on our website. If you have repossessed real property you can use this calculator to determine the gain or loss as well as its new basis. Accounting for an installment sales contract with a default repossession first determine the gross profit gross profit percentage on the contract Step-.

Subtract line 4 from line 2. The first step in calculating gains or losses is to determine the cost basis of the stock which is the price paid plus any associated commissions or fees. See the earlier discussions under Payments Received or Considered Received for items considered payment on the sale.

Gain or loss on repossession. The gain is the difference between the amount realized and the adjusted basis of the transferred property amount realized minus adjusted basis. Gross profit percentage for installment sale 4.

Enter unpaid balance of installment obligation 3. If the cash received is greater than the assets book value the difference is recorded as a gain. This will reduce the.

Total Amount Received From Sale Prior To Repossession This is the total amount you have been paid or have received for this property before it was repossessed. I received a 1099A from the bank with an amount for the debt - Answered by a verified Tax Professional. The decimal shows how much the gain represents compared to.

Enter an amount between 0 and 10000000. Subtract line 7 from line 1. Total Amount Received From Sale Prior To Repossession.

Your gain on repossession is the difference between the following amounts. For example assume you bought 10. Gain Previously Reported Deferred Or Excluded.

Under the regular rules the repossession gain loss equals the fair market value FMV of the property on the repossession date minus the basis of the installment note receivable at the time of the repossession minus any repossession costs see the. Any gain or profit you reported on the sale of this property. Chris figures his gain or loss on the repossession by comparing the.

Special rules may apply if the taxpayer repossesses. Figuring gain on repossession. As an example if you incurred a 25 fee to purchase the stocks and another 25 when you sold the stocks then your fees would total 50 and your adjusted net gain would be 450 ie 50 in fees subtracted from the 500 calculated previously.

1 Enter FMV of Repossessed property 2. This entry is required.

How To Remove A Repossession From Your Credit Report Lexington Law

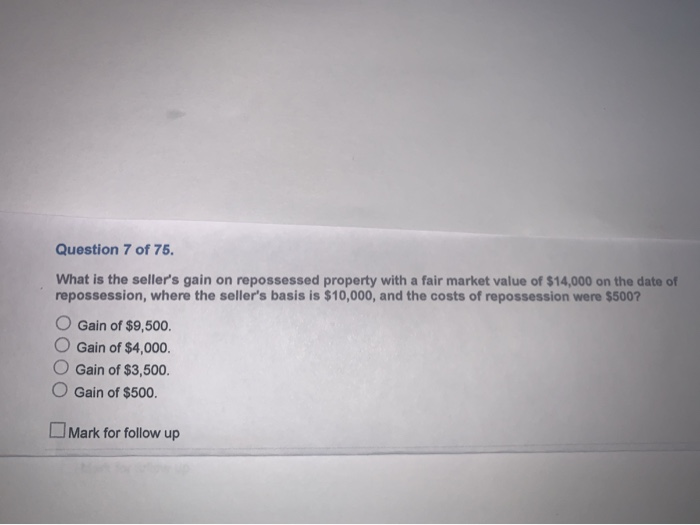

Question 42 Of 75 When Personal Property Is Chegg Com

Solved Rooster Co Uses The Installment Sales Method Relevant Information Follows 20x1 20x2 Sales 300 000480 000 Cost Of Sales 240 000336 000 Ins Course Hero

Reporting Installment Sales And Repossessions Ppt Download

Installment Sales Method Contract Default Repossesion A R Deferred Gross Profit Gain Loss Youtube

Question 7 Of 75 What Is The Seller S Gain On Chegg Com

How To Reach Financial Independence Financial Independence Budget Help Financial

Things You Must Know About Insurance Auto Auctions Looking For Guidelines Recommendations Information Visit Insurance Auto Auction Car Auctions Auto Ship

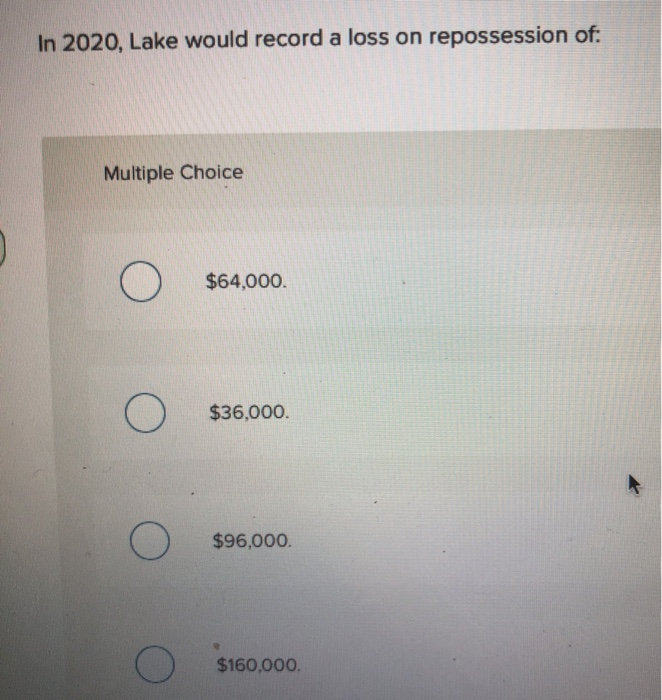

Lake Power Sports Sells Jet Skis And Other Powered Chegg Com

What Is The Difference Between Housing Repossession And Foreclosure Best Mortgage Lenders Medicaid Mortgage Payoff

Vehicle Repossession Order Form Five Things To Know About Vehicle Repossession Order Form Things To Know Lettering Order Form

Solved 456 Chapter 10 Installment Sales Method 457 Gives The Customer A Trade In Value Of P8 000 For The Old Merchandise And Subsequently Collects Course Hero

Installment Sales B Com Part Suroor Zafar S Academy Facebook

How To Remove A Repossession From Your Credit Report Lexington Law

Reporting Installment Sales And Repossessions Ppt Download

Repossession By Groce Dearmon P C

Installment Sales Reviewer Flip Ebook Pages 1 43 Anyflip Anyflip

Best Way To Pay Off Credit Card Debt Paying Off Credit Cards Credit Card Loans Credit Cards Debt

Posting Komentar untuk "How To Calculate Gain Or Loss On Repossession"