How To Not Pay Tax On Cryptocurrency Australia

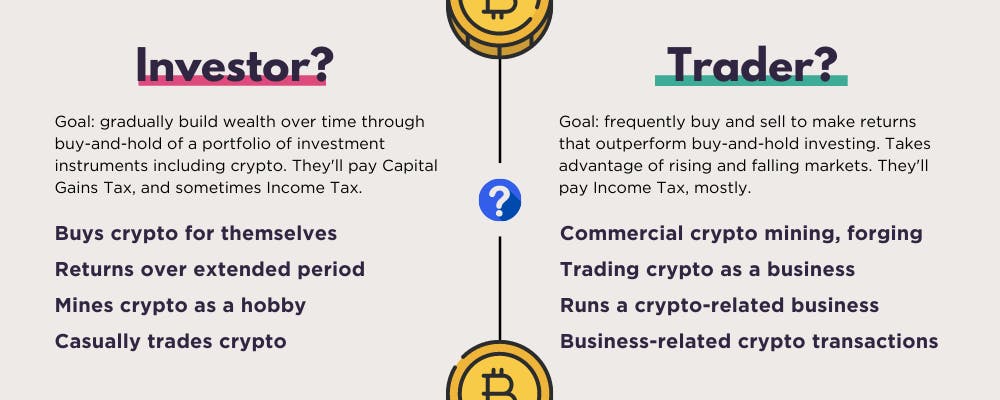

For all other cryptocurrency activities that do not fit the business criteria assets are considered a personal investment and are subject to CGT rules rather than those applied to income tax. Personal use asset The Australian tax code does have an exemption for items bought for personal use.

Crypto Tax Australia Cryptocurrency Tax 2021 Guide Fullstack

Beginners guide to cryptocurrency tax in Australia What you need to know about paying tax on your cryptocurrency in 2020.

How to not pay tax on cryptocurrency australia. The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain. Donating cryptocurrency is not considered a taxable event. Examples of personal crypto activities include.

Here is an example. If that price were to increase a substantial amount and your investment is now worth 10000000 would you have to pay tax on the 9998000 capital gains. If your strategy is to simply buy and hold your crypto then you dont need to pay tax on your cryptocurrency you hodl even if the value of your portfolio increases.

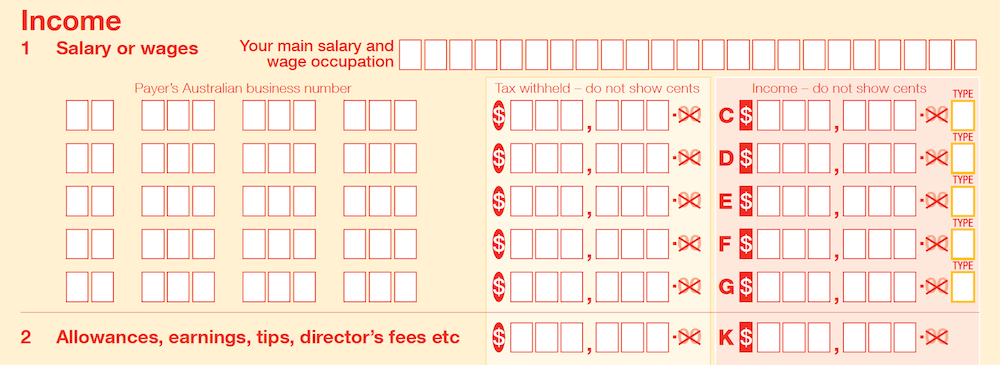

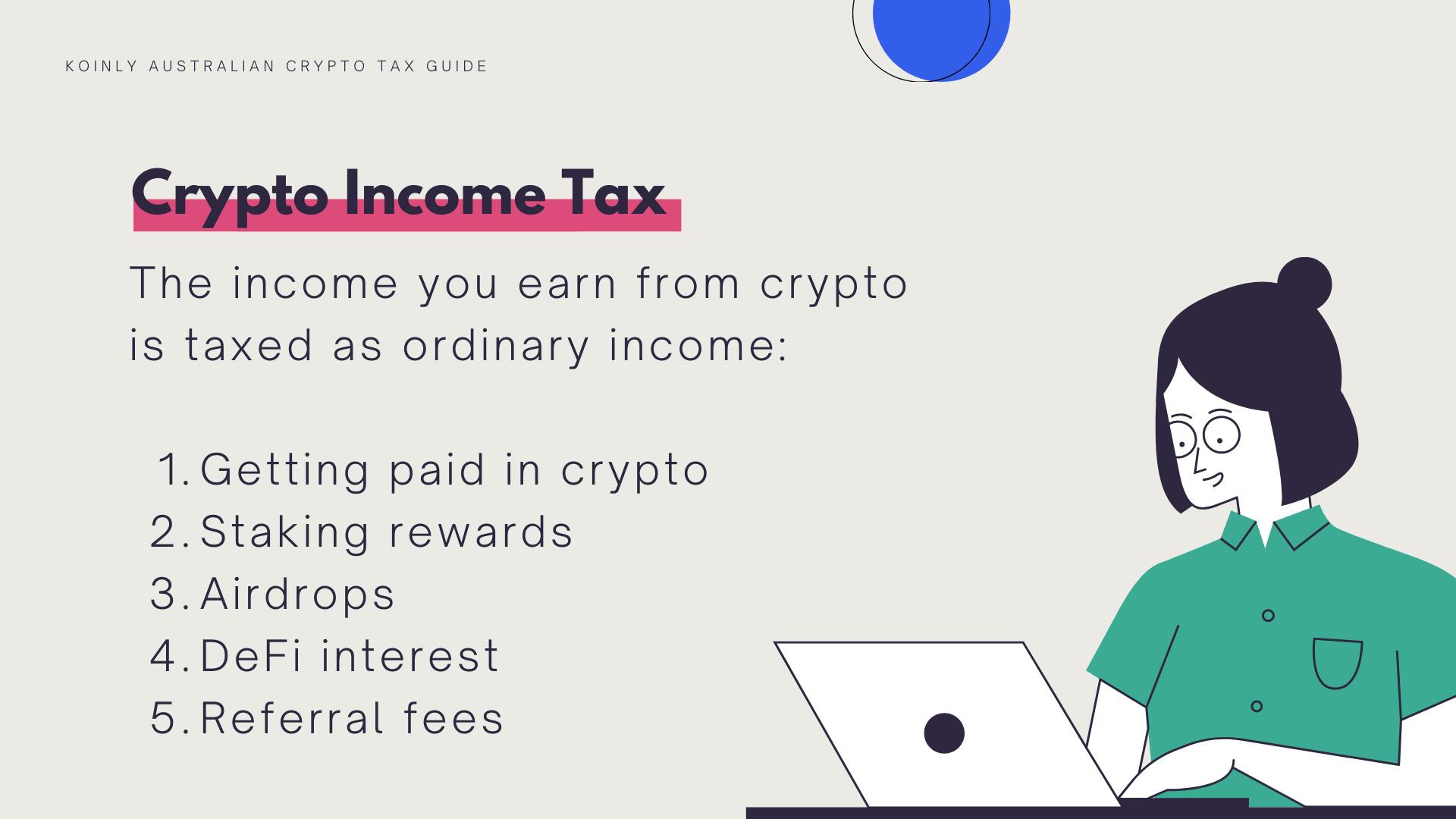

Personal Capital Gains Tax. On the day of the passing the heirs receive the coins at the current market price and wont be required to pay any sort of taxes. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your invididual circumstances.

Because you receive property instead of money in return for your cryptocurrency the market value of the cryptocurrency you receive needs to be accounted for in Australian dollars. However the ATO views lending cryptocurrency as a taxable event because crypto assets are not fungible. Cryptocurrency generally operates independently of.

If you only buy and hold then you dont need to pay tax on your crypto even if the value of your purchased coins increase. These are Concessional deductible Contributions and Non-Concessional Contributions. It is important that your attempts to minimise tax are not considered tax avoidance schemes.

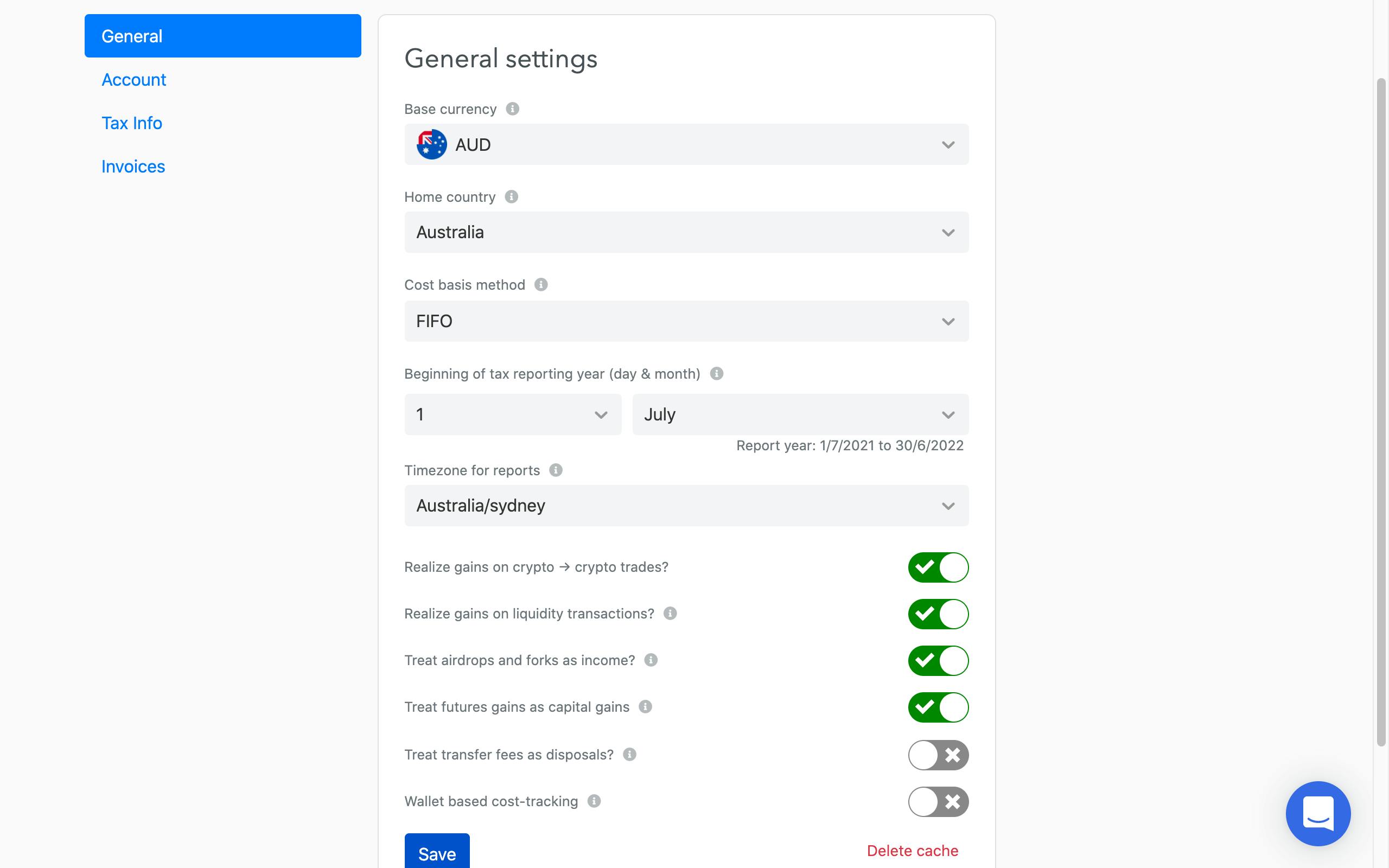

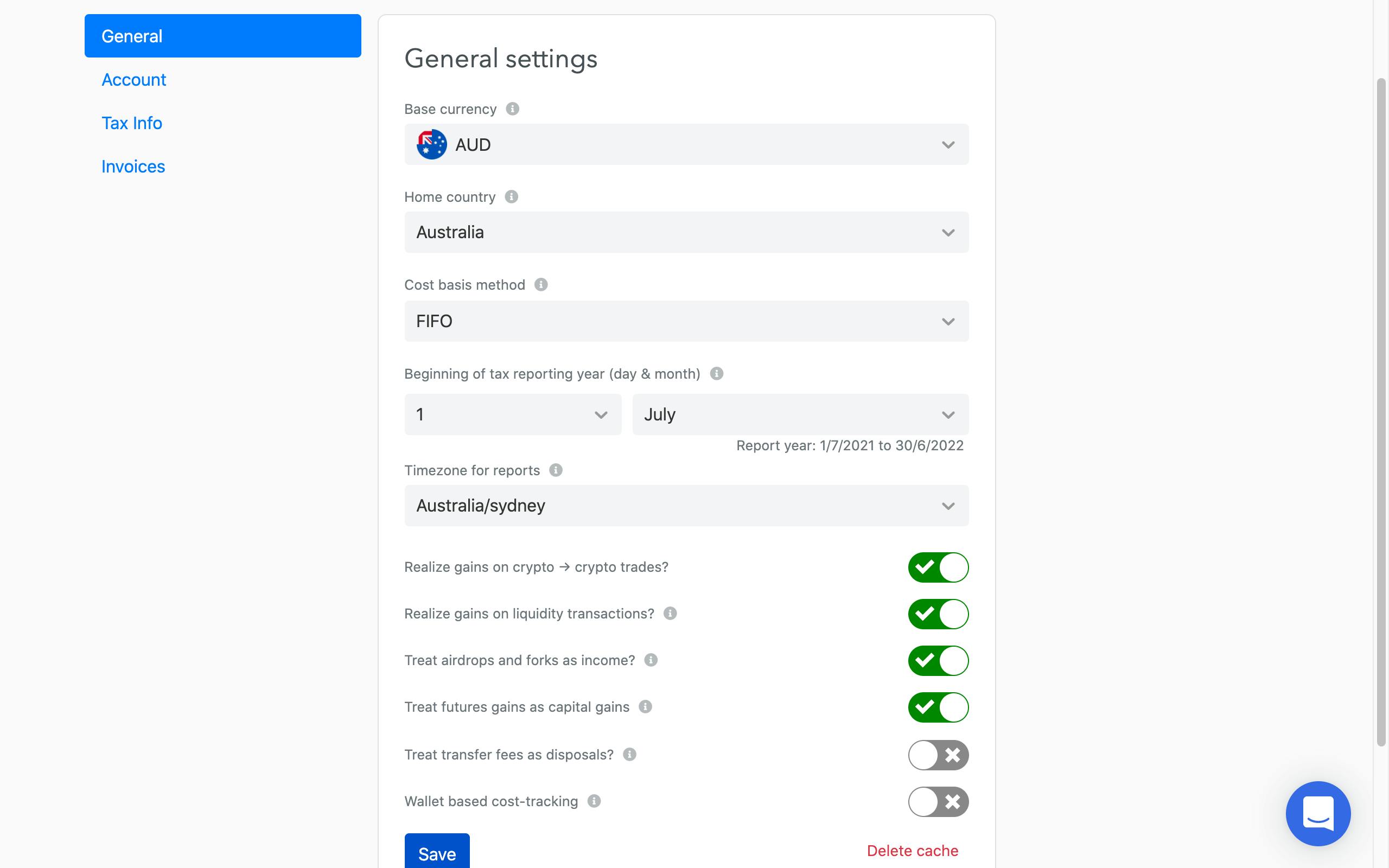

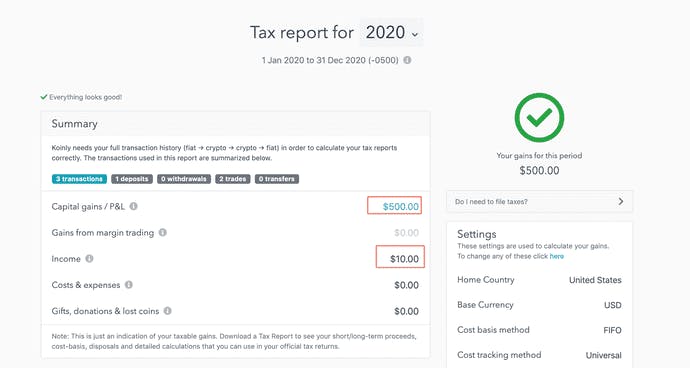

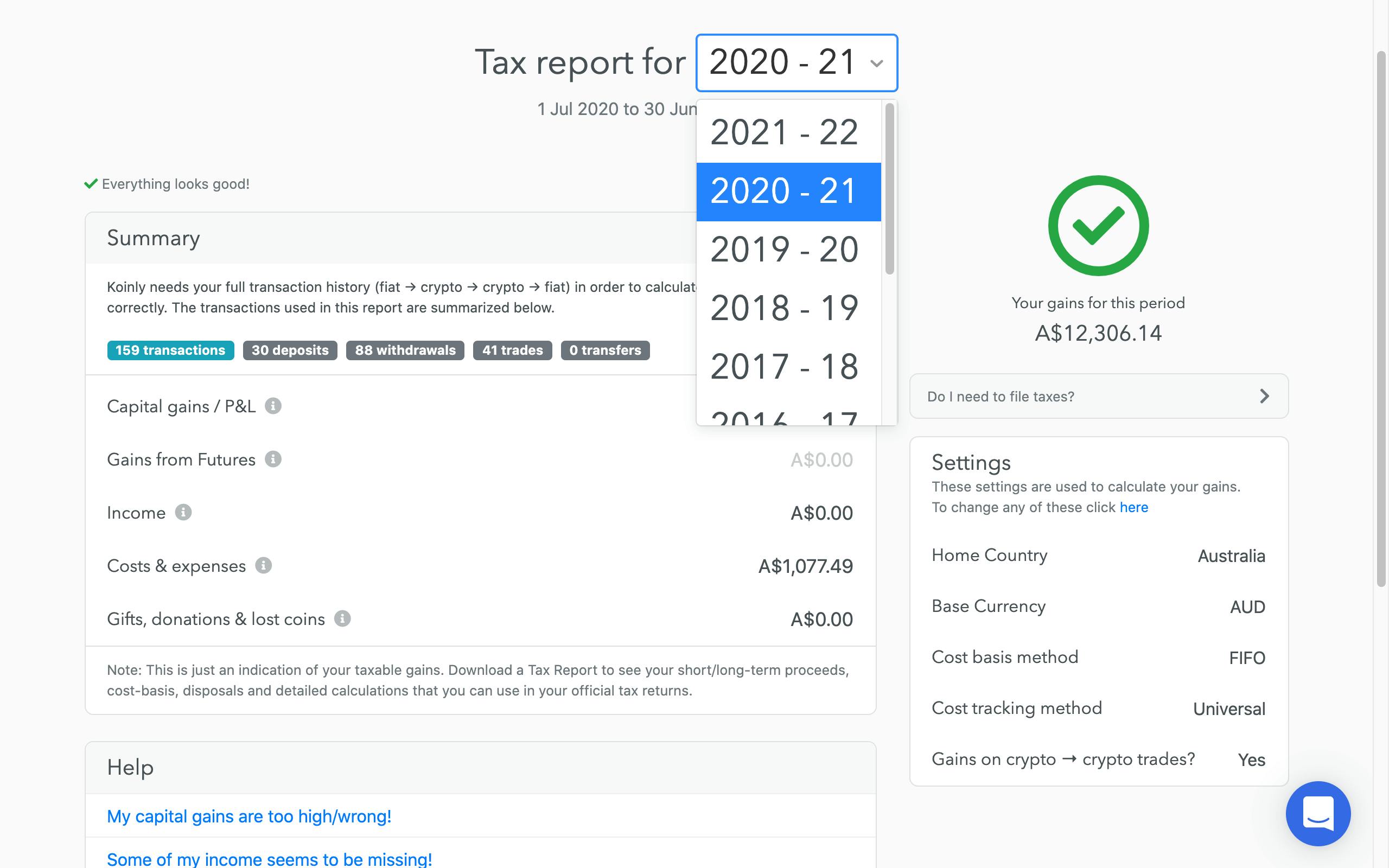

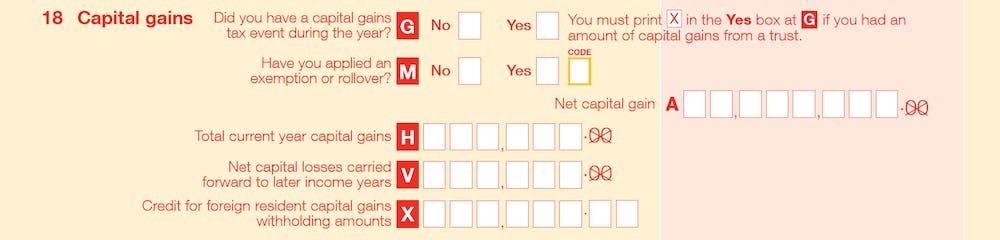

Superannuation funds are allowed a 33 13 CGT discount. Koinly Cryptocurrency Tax Reporting. A capital gains event only occurs when you do something with your crypto.

How is crypto tax calculated in Australia. If you make profit on a transaction then youll need to pay tax on your capital gain. In Australia cryptocurrencies are taxed when they are traded for goods and services exchanged into fiat currencies like the Australian dollar or cryptocurrency to cryptocurrency trades.

Purchasing cryptocurrency for yourself. If you simply buy and HODL then you dont need to pay tax on your cryptocurrency even if the value of your portfolio increases or decreases significantly. Lending fiat currency is not a taxable event.

Also as the tax. The taxable event is when you sell exchange or gift your crypto. If the cryptocurrency you received cant be valued the capital proceeds from the disposal are worked out using the market value of the cryptocurrency you disposed of at the time of the transaction.

Lets say that you purchase some cryptocurrency while the price is very low and you purchase 2000 worth. So yes you will have to pay tax on cryptocurrency in Australia. Most taxpayers are subject to income tax on the premise their cryptocurrency holdings are capital assets whereby any gains realized from the disposal of cryptocurrency holdings are taxed as capital gains but they are allowed a 50 CGT discount where the taxpayer is an individual or a trust.

For example if you were to lend 1 BTC purchased for A10000 and receive 8000 DAI worth A11000 the ATO sees it as a disposition of your original 1 BTC. You will be able to deduct the value of your cryptocurrency at fair market value in Australian dollars at the time of the donation. Superannuation Contributions There are two types of contributions that can be made to superannuation.

Tax treatment of cryptocurrencies. A private placement policy is held until the persons death by which time the cryptocurrencies will be passed onto the legal heirs tax-free. Here are the two legal ways avoid paying certain taxes.

If you make a profit on a transaction then youll need to pay tax on your capital gain. The gains or losses made from cryptocurrency are considered for income tax purposes and they can be treated as trading income or capital gains on investment s depending on a number of factors. The ATO wants to know if youre buying trading mining staking or giving and receiving cryptos regardless of whether the transaction was processed here using the Australian Dollar in El Salvador or any other.

And not just on the sale of your cryptocurrency coins. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto.

Australian Cryptocurrency Tax Guide 2021 Koinly

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Australian Cryptocurrency Tax Guide 2021 Koinly

Germany Cryptocurrency Tax Guide 2021 Koinly

Australian Cryptocurrency Tax Guide 2021 Koinly

3 Ways To Pay No Tax Less Tax On Cryptocurrency Profits With Crypto Tips Crypto Taxes Youtube

Top 10 Crypto Tax Return Software For Australia Crypto News Au

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Australian Cryptocurrency Tax Guide 2021 Koinly

Australian Cryptocurrency Tax Guide 2021 Koinly

Australian Cryptocurrency Tax Guide 2021 Koinly

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Crypto Tax Australia Guide 2021 Cryptocurrency Tax Swyftx

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Crypto Tax In Australia The Definitive 2021 Guide

Australian Cryptocurrency Tax Guide 2021 Koinly

Australian Cryptocurrency Tax Guide 2021 Koinly

Australian Cryptocurrency Tax Guide 2021 Koinly

Australian Cryptocurrency Tax Guide 2021 Koinly

Posting Komentar untuk "How To Not Pay Tax On Cryptocurrency Australia"